05 Best Share Market Tips

Although there are a lot of opportunities to make money in the stock market, success takes more than luck; it also involves dedication, strategy, and expertise. Following tried-and-true advice will help you manage the market’s complexity and make wise judgments, regardless of your level of experience. Building a lucrative portfolio requires careful study and effective risk management, both of which are essential. Let’s examine five crucial share market pointers that will help you achieve financial achievement.

1. Before making an investment, do extensive research 📊

- Recognize the market performance of the sector.

- Examine the cash flow, profit and loss statement, and balance sheet.

- To determine whether the stock is reasonably valued, look at the P/E ratio, EPS, and book value.

- To determine who has a competitive advantage, compare with other businesses.

2. Diversify Your Portfolio

- To lower risk, distribute investments throughout several sectors, such as IT, pharmaceuticals, finance, and fast-moving consumer goods.

- For instance, IT or FMCG stocks may still do well even if the auto industry is struggling. It lowers risk and aids in balancing earnings and losses.

.

3. Make Long-Term Investments ⏳

- Stock markets reward long-term investors despite their short-term volatility.

- Take advantage of dips and refrain from panic selling during corrections.

- For instance, TCS and Reliance Industries have produced multi-bagger returns over many years.

4. Monitor News & Market Trends 📰

- Keep up of world events, inflation rates, company earnings reports, RBI policies, and geopolitical threats.

- For stock market news, visit financial websites such as Moneycontrol, Bloomberg, and Economic Times. The secret to keeping ahead is knowledge.

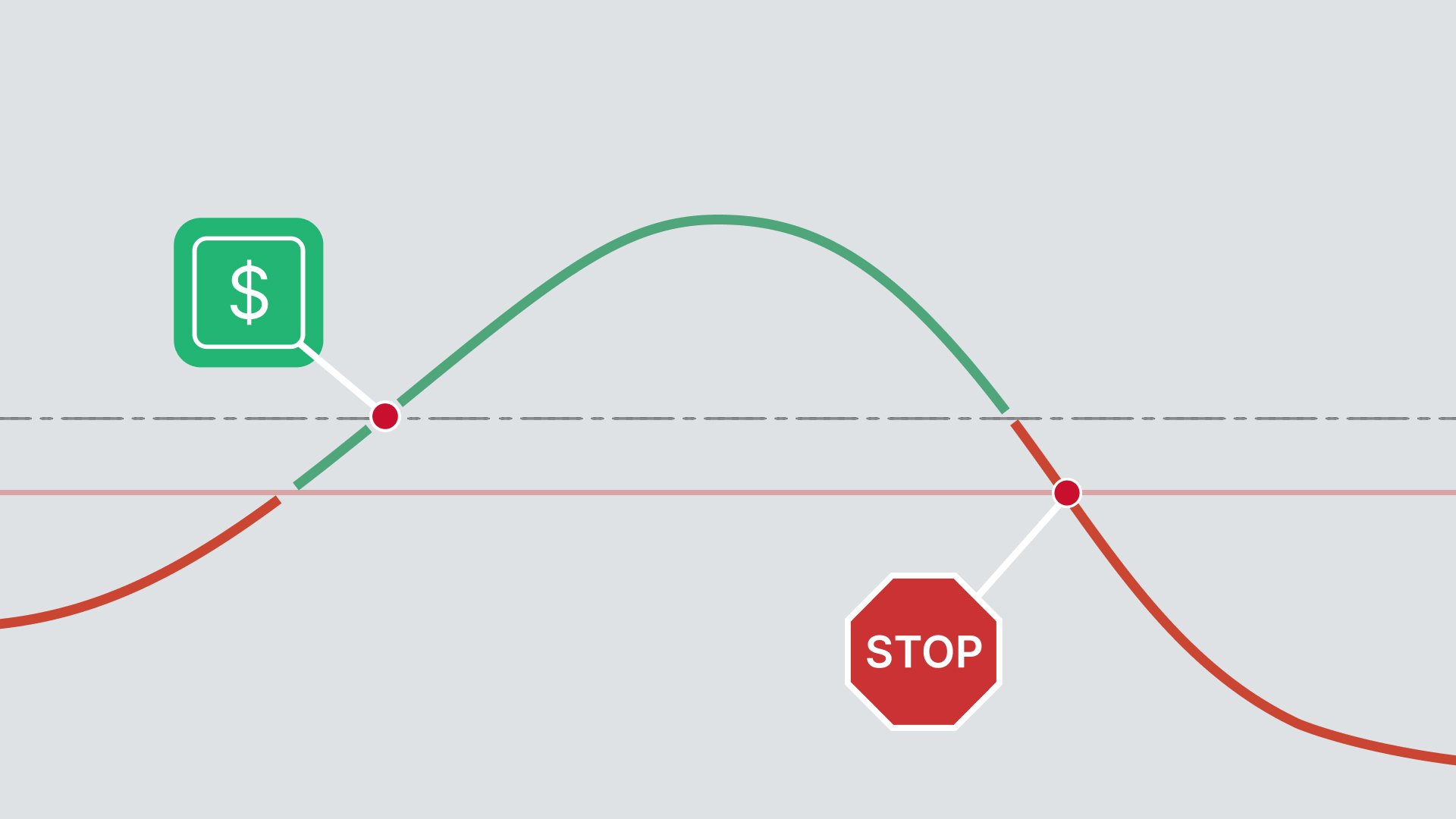

5. Put Risk Management Into Practice

- Always have a stop-loss in place to guard your capital and reduce losses.

- Remember the 80-20 rule: invest 20% in high-risk equities and 80% in safe stocks.

- Don’t put money into investments you can’t afford to lose.